Trusted by Arizona Real Estate Investors

Wholesaling Apache Junction Properties Shouldn't Be This Hard

Real wholesalers sharing their frustrations with Batch Leads and PropStream

These are real complaints from real estate investors. MagicList was built to solve these exact problems with both Batch Leads and PropStream.

Built for Real Estate Investors in Apache Junction

Whether you're starting out or scaling up in Apache Junction, MagicList gives you the edge

New Investors

You're just getting started in Apache Junction foreclosures

Perfect if you're:

- •Looking for your first 1-3 deals in Apache Junction

- •Want properties under $200K

- •Need step-by-step property data

- •Have limited capital to deploy

What you get:

Pre-qualified Apache Junction leads with clear equity positions, owner contact info, and property details. No more sifting through courthouse records or paying for generic lists.

Learn moreActive Wholesalers

You need fresh Apache Junction deals before they're picked over

Perfect if you're:

- •Running 5-15 deals per month in Apache Junction

- •Building buyer lists for specific property types

- •Need early warning on high-equity properties

- •Want to beat other wholesalers to opportunities

What you get:

3-6 month lead time on Apache Junction properties, Substitution of Trustee early warnings 45 days before Notice of Sale, and predictive signals that identify distressed sellers before they show up in public records.

Learn moreFix & Flip Operators

You're buying, renovating, and selling in Apache Junction at scale

Perfect if you're:

- •Experienced flippers doing 2-5+ flips per month

- •Need Apache Junction properties with 50%+ equity

- •Looking for owner-occupied distressed properties

- •Want predictable deal flow

What you get:

High-equity filters for Apache Junction, property condition indicators, market value vs. assessed value analysis, and owner-occupancy status to identify motivated sellers.

Learn moreInvestment Firms & Funds

You're deploying capital systematically in Apache Junction

Perfect if you're:

- •Managing portfolios of 10+ properties

- •Need high-volume deal flow in Apache Junction

- •Multiple acquisition strategies simultaneously

- •Want comprehensive market coverage

What you get:

All-access pass to every Apache Junction list, early access to new lists as they're published, and the ability to download in multiple formats for your team's workflow.

Learn morePre-Built Lists for Apache Junction Properties for Every Strategy

We've done the filtering for you. Just pick your strategy and start dialing Apache Junction deals.

Flip-Ready SFRs Under $250K in Apache Junction

New investors and small-scale flippers

Criteria:

- •Single-family residences only

- •Purchase price under $250K

- •Minimum 25% equity position

- •Owner-occupied properties (motivated sellers)

- •Located in Apache Junction growth corridors

Typical properties:

3br/2ba homes in Apache Junction with $50K-$80K equity positions. Perfect for first-time flippers and small-scale investors.

Tiered Scoring

Hot to Lukewarm ratings

New Investor Bundle Under $200K

First-time foreclosure investors

Criteria:

- •All property types (SFR, condos, townhomes)

- •Purchase price under $200K

- •Minimum 30% equity

- •Clear title (no complex lien situations)

- •Skip tracing data included

Typical properties:

Entry-level homes and condos in Apache Junction neighborhoods with straightforward deals and motivated sellers.

Tiered Scoring

Hot to Lukewarm ratings

High-Equity Cash Cows (50%+ Equity)

Experienced investors and wholesalers

Criteria:

- •50%+ equity positions

- •All property types

- •Properties in pre-foreclosure (3-6 months from auction)

- •Owner contact information verified

- •Market value $150K-$500K

Typical properties:

Distressed Apache Junction owners with significant equity who need fast exits. Prime wholesale or subject-to opportunities.

Tiered Scoring

Hot to Lukewarm ratings

Pre-Pre-Foreclosure Early Warnings

Advanced investors who want first-mover advantage

Criteria:

- •Predictive signals indicate likely NTS filing in next 90-180 days

- •Delinquent property taxes (2+ quarters)

- •Recent Substitution of Trustee filings

- •Not yet showing Notice of Trustee Sale

Typical properties:

Apache Junction properties that will become foreclosure opportunities before they show up on anyone else's radar.

Tiered Scoring

Hot to Lukewarm ratings

Substitution of Trustee - 45 Day Heads Up

Wholesalers who need pipeline visibility

Criteria:

- •Substitution of Trustee filed in last 7 days

- •Statistically leads to NTS filing within 45 days

- •Minimum 20% equity

- •Owner-occupied properties preferred

Typical properties:

Early warning system for Apache Junction deals about to hit the market. Contact owners before the Notice of Sale is filed.

Tiered Scoring

Hot to Lukewarm ratings

28 Data Points. One Complete Picture.

Everything you need to qualify a deal in 60 seconds

| Category | Data Point | Description |

|---|---|---|

Document Intelligence | Filing Date | When the foreclosure was initiated |

| Document Type | NS, DOT, WD, ST classification | |

| Trustee Information | Who's managing the foreclosure | |

| Original Lender | Who originated the loan | |

| Current Beneficiary | Who owns the debt now | |

| Original Loan Amount | Initial financing amount | |

| Filing Number | County recorder reference | |

Property Details | Property Address | Full address with unit # |

| APN (Assessor's Parcel Number) | Official property ID | |

| Property Type | SFR, Condo, Townhome, Multi-family | |

| Square Footage | Living space | |

| Lot Size | Land area | |

| Bedrooms / Bathrooms | Property specs | |

| Year Built | Construction year | |

| Assessed Value | County tax assessment | |

| Market Value | Current estimated value | |

Financial Analysis | Equity Position | Current equity percentage |

| Equity Amount | Dollar amount of equity | |

| Loan-to-Value Ratio | Current LTV | |

| Property Tax Status | Current/delinquent | |

| Tax Amount | Annual property taxes | |

Owner Intelligence | Owner Name(s) | Property owner(s) |

| Owner-Occupied Status | Primary residence indicator | |

| Mailing Address | Where to send offers | |

| Length of Ownership | Years owned | |

| Phone Number | Skip traced contact info (Pro plan) | |

| Email Address | Alternative contact (Pro plan) | |

Investment Scoring | Lead Quality Score | A/B/C/D tier rating |

| Equity Score | Weighted equity rating | |

| Motivation Score | Distress indicators | |

| Deal Velocity Score | Time to auction |

We Learned from

Batch Leads' Mistakes

Old tools slow your team down and don't help you close faster.

We built something better.

Batch Leads / PropStream Problems

- Generic nationwide data with no local focus

- Pay $149-299/month for platform access, then pay again for skip tracing ($0.10-0.25 per lead)

- Weekly or monthly updates mean you see deals days or weeks late

- No lead scoring - you filter through thousands of unqualified properties

- Only see properties at auction, missing the 3-6 month early opportunity window

- Blind subscription - can't preview property quality or counts before paying

- Scattered data requiring hours of manual filtering and research

- Same generic lists everyone else has - no competitive advantage

The MagicList Solution

- Arizona foreclosure specialists with deep local expertise

- $$49-199/month with free skip tracing - no hidden per-lead fees

- Updated every 6 hours - see opportunities before competition

- A/B/C scoring system automatically qualifies leads for you

- 3-6 month early warnings with Substitution of Trustee alerts

- Preview sample properties and counts before subscribing

- 28 enriched data points in one place - qualify deals in 60 seconds

- Curated pre-qualified lists tailored to your investment strategy

Why MagicList?

Transform foreclosure filings into qualified investment opportunities automatically

Early Opportunity Detection

Get notified 3-6 months before properties hit auction. Track Substitution of Trustee filings 45 days before Notice of Trustee Sale.

AI-Powered Lead Qualification

Advanced 4-tier classification system scores properties based on equity percentage, owner-occupancy, loan type, and data quality.

Comprehensive Property Intelligence

28 enrichment fields including assessed values, market values, owner information from local assessor records.

Document Processing

Automated OCR and AI extraction of Notice of Sale, Deed of Trust, Warranty Deed, and Substitution of Trustee documents.

High-Equity Focus

Filter for distressed properties with significant equity. Perfect for wholesalers, fix-and-flip operators, and investors.

Predictive Capabilities

Identify "pre-pre-foreclosure" properties using early warning signals like delinquent taxes and code violations.

STATS

Numbers That Show the Difference

Real metrics that demonstrate why MagicList outperforms traditional lead platforms

Processing Speed

Fresh foreclosure data updated 4 times daily

AI-powered document processing precision

Comprehensive data enrichment for each lead

Cost Savings

Save $100-250/month on contact data

Cheaper than Batch Leads or PropStream

No more manual filtering and qualifying

Competitive Advantage

With Substitution of Trustee filings

Hot, warm, and lukewarm tier scoring

Verified owner contact information

- 01

Automated Monitoring

We check local government sources every 6 hours for new foreclosure filings, so you never miss an opportunity.

- 02

Document Processing

Our AI reads and extracts key details from legal documents like Notice of Sale and Substitution of Trustee filings automatically.

- 03

Owner & Property Research

We match properties to their owners, combine duplicate records, and build a complete history of each property for accurate insights.

- 04

Lead Scoring

Using our proprietary AI algorithms, we automatically score and rank leads from A to C based on equity, owner status, and deal potential.

- 05

MagicList Delivery

Receive curated lists of high-equity opportunities before they hit auction. Filter by price, equity, and investment strategy.

Only Pay for Lists You Actually Want

No per-lead fees. No credit systems. Just subscribe to the lists that match your strategy.

| Features | Single List | 3-List Bundle | All-Access |

|---|---|---|---|

| Number of Lists | 1 list | 3 lists | All lists (5+) |

| Properties per List | Unlimited | Unlimited | Unlimited |

| Skip Tracing | |||

| Real-Time Updates | Every 6 hours | Every 6 hours | Every 6 hours |

| Lead Scoring | |||

| CSV/Excel Export | |||

| Early Access to New Lists | |||

| Priority Support | |||

| Team Accounts |

What You're NOT Paying For

Ready to Find Your Next Deal?

Join Arizona investors discovering foreclosure opportunities before the competition

Updates & Articles

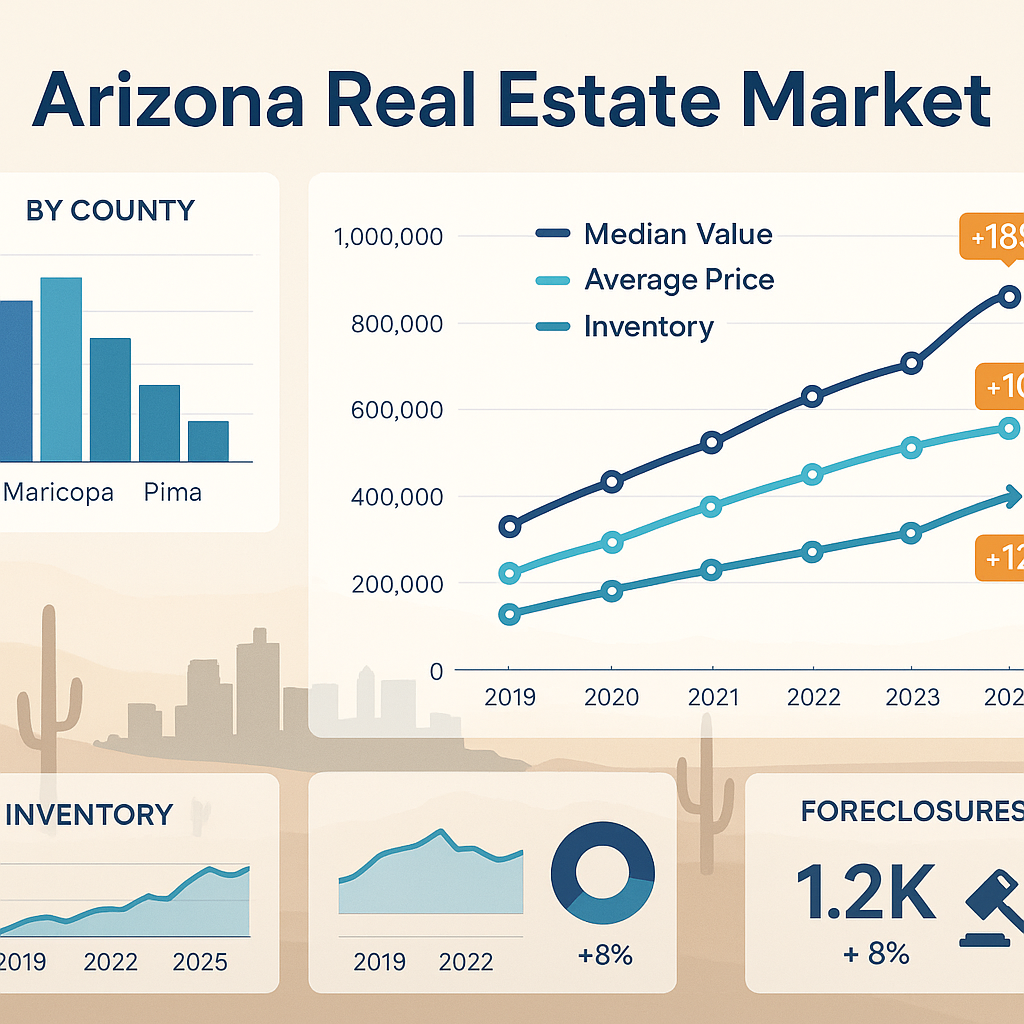

Stay informed with the latest insights on Arizona foreclosure investing, market trends, and MagicList updates.

View all articles

Arizona Foreclosure Market Trends in 2025

Discover the latest trends in Arizona's foreclosure market and learn how to identify high-equity opportunities before your competition.

Why We Created MagicList: The Story Behind Arizona's Foreclosure Intelligence Platform

Discover the story behind MagicList - how 15 years of building tech companies led to creating Arizona's premier foreclosure intelligence platform for real estate investors.

Who Is MagicList For? A Complete Guide to Our Target Audience

Learn who benefits most from MagicList's foreclosure intelligence platform - from new investors to active wholesalers and fix-and-flip operators in Arizona.