Enterprise Foreclosure Intelligence for Investment Firms

Comprehensive Market Coverage for Portfolio Growth

The Portfolio Investor Challenge: Consistent, Scalable Deal Flow

Managing 10+ properties requires different infrastructure than buying 1-2 deals. Move from retail processes to institutional systems.

Manual Workflows

Browsing foreclosure websites one-by-one, no systematic approach to opportunity identification

Data Inconsistency

Team members tracking deals in separate spreadsheets—no single source of truth

Workflow Bottlenecks

Missing opportunities because deals get stuck between sourcing, underwriting, and approval

No Prioritization

Every opportunity looks the same—wasting time on low-probability deals instead of best opportunities

Institutional Approach with MagicList

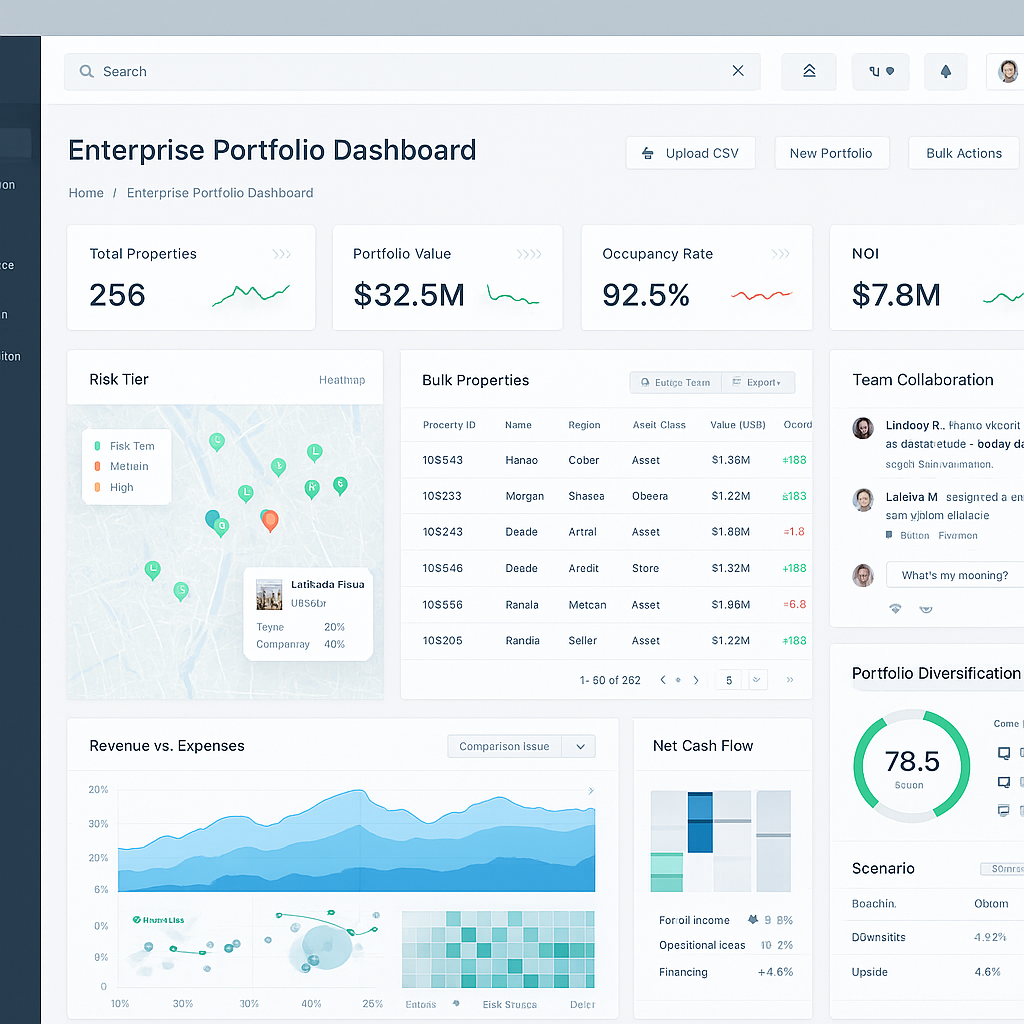

Automated pipeline, API integration, team collaboration, and systematic prioritization for portfolio-scale acquisitions.

Automated pipeline feeding multiple acquisition strategies—API integration with Dealpath, Salesforce, custom CRM

Team collaboration with role-based access—acquisitions, asset management, finance teams work from single platform

Algorithmic scoring and prioritization—Tier 1 opportunities (top 5%) flagged for immediate review

Retail Investor Approach

Manual processes that don't scale beyond 1-2 deals at a time. Workflow bottlenecks and missed opportunities.

Manually browse foreclosure websites—call individual homeowners one-by-one with no systematic approach

Track spreadsheets across team members—inconsistent data quality, no single source of truth

Miss opportunities due to workflow bottlenecks—no systematic prioritization of best deals

Multi-Strategy Acquisition Intelligence

Single platform supporting multiple investment strategies—each property tagged for applicable use cases

Fix & Flip Pipeline

High-equity (50%+) distressed properties with ARV analysis and renovation cost estimates

BRRRR Strategy

Strong rental market fundamentals with cash flow projections and refinance viability analysis

Wholesale Assignment

Ultra-high equity (60%+) opportunities with assignment fee calculations and buyer matching

Buy & Hold Rental

Stable neighborhoods with rental demand indicators, cap rate calculations, and appreciation metrics

Opportunistic Value-Add

ADU potential, lot splits, zoning changes, assemblage candidates, and redevelopment sites

Bulk Portfolio Acquisition

Lender relationship strategy—identify banks with highest foreclosure volume for bulk deals

See Enterprise Features in Action

Schedule a demo to see API integration, team collaboration tools, and multi-strategy pipeline management

Enterprise-Grade

Foreclosure Intelligence

50+ data points per property, API access,

and 6-hour early access to premium opportunities

Comprehensive Market Coverage

- Notice of Default (NOD) filings—Early stage opportunities

- Substitution of Trustee (ST)—45-day advance warning

- Notice of Trustee Sale (NTS)—Public auction announcements

- Maricopa County complete coverage (Phoenix metro)

- Pinal County (Casa Grande, Apache Junction)

- 50+ data points: liens, equity %, ownership intel, contact info

- API integration with Dealpath, Salesforce, Yardi, custom CRM

- Role-based team access with audit trails

4-Tier Prioritization System

- Tier 1: Premium (Top 5%):60%+ equity, owner-occupied, A/B areas—Immediate review

- Tier 2: Strong (Next 15%):40-60% equity, solid neighborhoods—Standard pipeline

- Tier 3: Consider (Next 30%):25-40% equity—Monitor or wholesale opportunities

- Tier 4: Watch List (50%):Under 25% equity—Predictive monitoring for future opportunity

- Early Access Program:6-hour head start on Tier 1 properties before release

- Custom Scoring:Adjust weights based on your fund mandates and strategies

- Portfolio Analytics:Market trends, deal flow metrics, foreclosure density maps

- API Performance:99.9% uptime, <200ms response, 10,000 calls/month included

Enterprise Success Stories

"We were deploying $5-10M annually in Arizona foreclosures but deal flow was inconsistent. MagicList's API integration feeds our deal pipeline automatically. Acquisitions team reviews 30-50 Tier 1 opportunities monthly vs. 10-15 previously. Increased deployment to $15M annual run rate."

"The early access program is worth the premium. We converted 40% of Tier 1 opportunities contacted in first 6 hours vs. 15% when we waited for standard release. First-mover advantage in seller relationships is significant."

Ready to Scale Your Acquisition Operations?

Join REITs, private equity funds, and family offices leveraging MagicList for systematic foreclosure acquisition. API access, team collaboration, and early access to premium opportunities.